In the dynamic world of financial markets, the ability to accurately analyze and predict trends is invaluable. Among the plethora of technical analysis tools available to traders and investors, moving averages stand out for their simplicity and effectiveness. This comprehensive guide delves deep into the concept of moving averages, exploring their types, calculation methods, and practical applications in trend analysis. Whether you’re a seasoned trader or a newcomer to the markets, understanding how to leverage moving averages will significantly enhance your trading strategy and decision-making process.

Decoding the Gartley Pattern: Harmonics in Trading

Understanding Moving Averages

The Basics of Moving Averages

- Explanation of what moving averages are and why they are essential in technical analysis.

- Differences between simple moving averages (SMA) and exponential moving averages (EMA).

Calculating Moving Averages

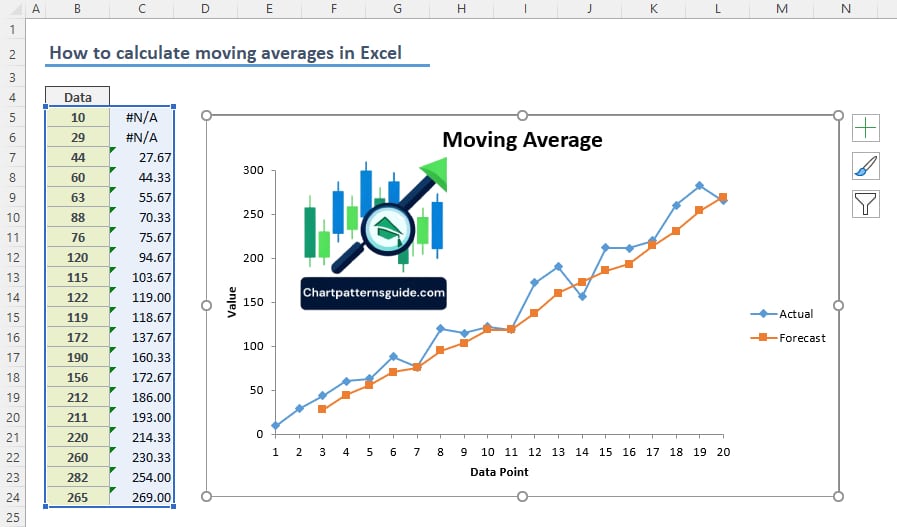

- Step-by-step guide on how to calculate SMAs and EMAs.

- The significance of choosing the right period for your moving average.

Types of Moving Averages

- Overview of various types of moving averages beyond SMAs and EMAs, such as weighted moving averages (WMA) and smoothed moving averages (SMMA).

- How each type of moving average can be applied to different trading strategies.

Moving Averages in Trend Analysis

Identifying Market Trends

- How to use moving averages to identify uptrends and downtrends.

- Examples of short-term, medium-term, and long-term trend analysis using moving averages.

Moving Average Crossovers

- The concept of moving average crossovers and their significance in signaling trend reversals.

- Case studies illustrating successful trades based on moving average crossovers.

Support and Resistance Levels

- Exploring how moving averages can act as dynamic support and resistance levels.

- Real-world examples of moving averages providing key entry and exit points.

Advanced Strategies Using Moving Averages

Multiple Moving Averages

- Utilizing two or more moving averages simultaneously for more refined trend analysis.

- Examples of popular multiple moving average strategies, such as the Moving Average Ribbon.

Moving Averages and Other Technical Indicators

- Combining moving averages with other technical indicators like MACD, RSI, and Bollinger Bands to enhance trading signals.

- Practical applications and examples of multi-indicator strategies.

Challenges and Limitations

- Discussing the limitations and potential pitfalls of relying solely on moving averages for trading decisions.

- How to mitigate these challenges through comprehensive market analysis and risk management.

Moving averages are a cornerstone of technical analysis, offering traders and investors a simple yet powerful tool for trend analysis. By understanding and correctly applying moving averages, you can uncover valuable insights into market dynamics, improve your trading accuracy, and make more informed investment decisions. This guide aims to equip you with the knowledge and skills to leverage moving averages effectively, enhancing your analytical toolkit and supporting your success in the financial markets.