In the intricate world of financial markets, traders and analysts strive to decipher the signals that predict future price movements. Among the myriad of technical analysis tools, the Gartley pattern stands out for its precision and reliability. Named after H.M. Gartley, who introduced it in his 1935 book “Profits in the Stock Market,” the Gartley pattern has become a cornerstone in harmonic trading due to its unique ability to identify turning points with remarkable accuracy. This article embarks on a comprehensive exploration of the Gartley pattern, unraveling its components, significance, and strategies for leveraging its power in trading endeavors.

Inverse Head and Shoulders Pattern: Signaling Bullish Reversals

Understanding the Gartley Pattern

Origins and Development

- Brief history of H.M. Gartley and the pattern’s introduction.

- Evolution of the Gartley pattern in modern trading.

Components of the Gartley Pattern

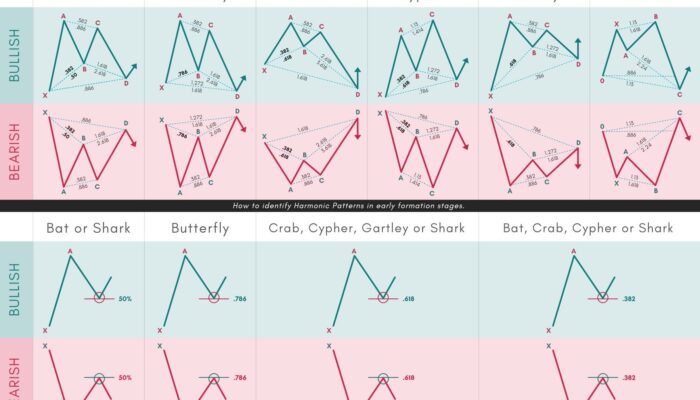

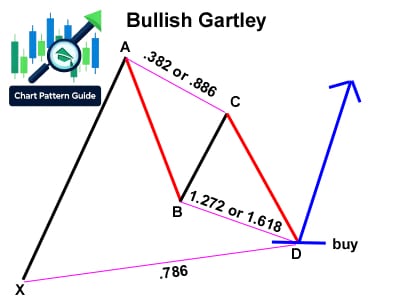

- Detailed breakdown of the Gartley pattern structure (X-A, A-B, B-C, and C-D legs).

- The role of Fibonacci ratios in defining the pattern’s harmonic levels.

Theoretical Foundation

- Explanation of harmonic trading principles.

- The significance of Fibonacci numbers in market analysis.

Identifying the Gartley Pattern

- Step-by-step guide on spotting the Gartley pattern on charts.

- Tips for distinguishing between ideal and imperfect formations.

Interpreting the Gartley Pattern

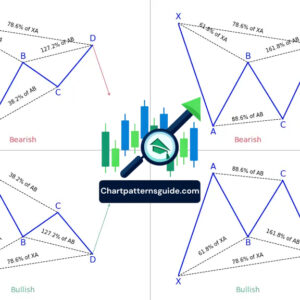

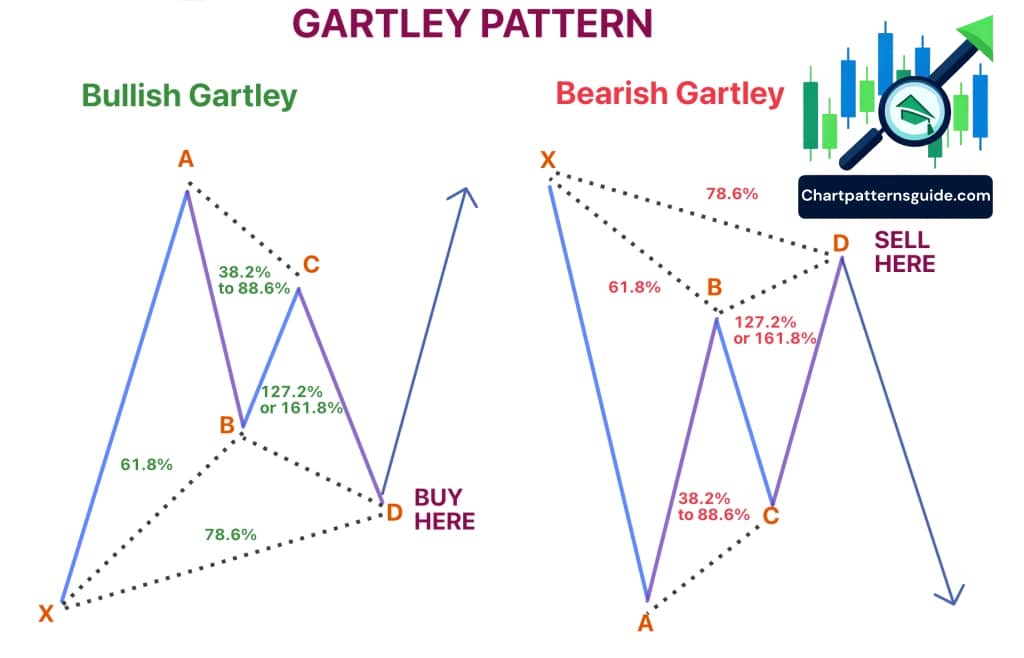

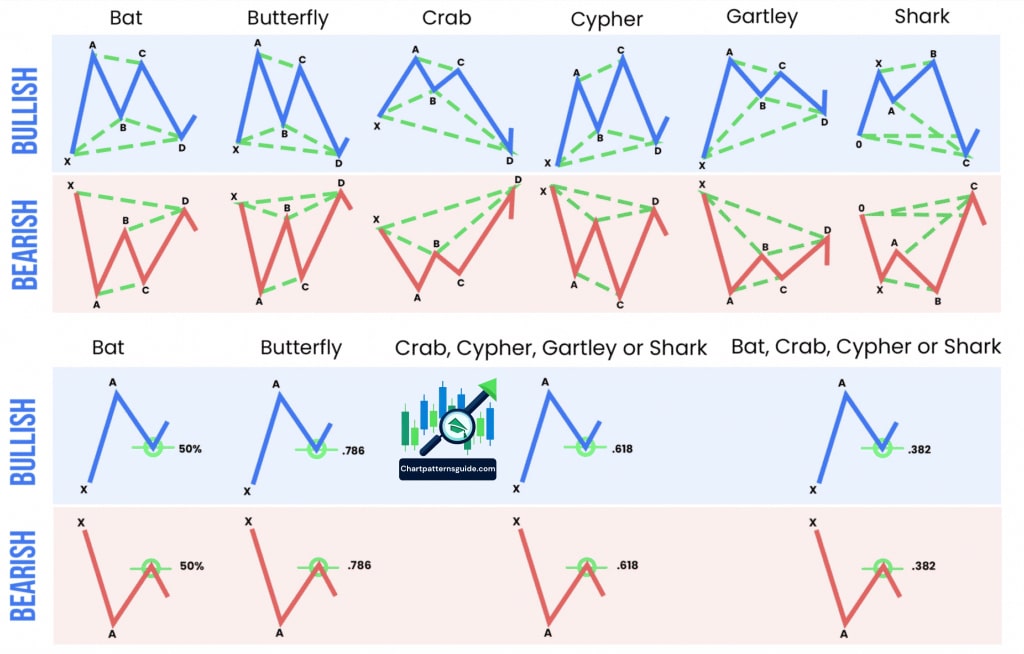

Bullish vs. Bearish Gartley

- Characteristics and differences between bullish and bearish Gartley patterns.

- Visual examples and chart illustrations.

Gartley Pattern Variations

- Introduction to variations like the Bat, Butterfly, and Crab patterns.

- How these variations fit into the broader concept of harmonic trading.

Trading Strategies Based on the Gartley Pattern

Entry Points

- Strategies for determining optimal entry points within the Gartley pattern.

- The importance of pattern completion and confirmation signals.

Stop-Loss and Profit Targets

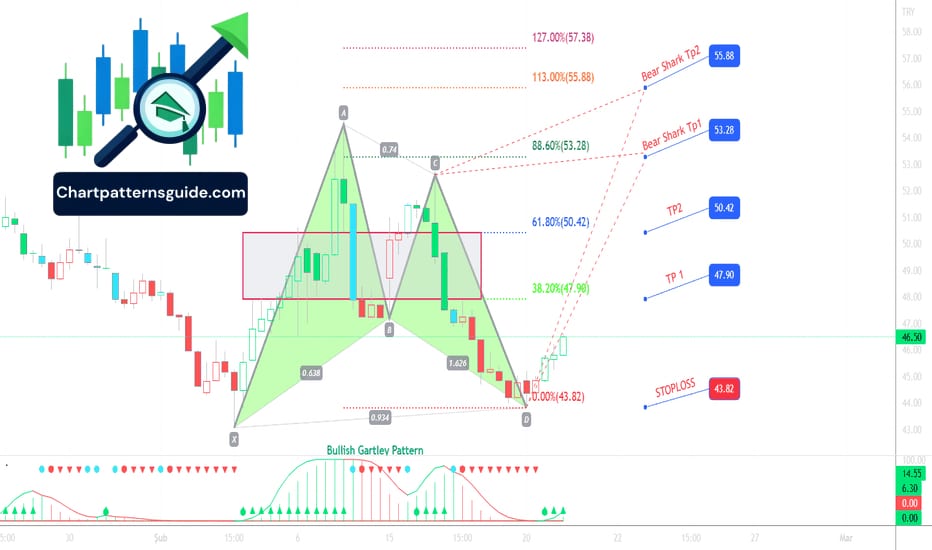

- Calculating risk-reward ratios and setting stop-loss orders.

- Using Fibonacci extensions and retracements to define profit targets.

Advanced Techniques

- Combining the Gartley pattern with other technical analysis tools.

- Role of volume and market sentiment in confirming Gartley signals.

Practical Applications and Case Studies

Real-World Examples

- Analysis of successful trades based on the Gartley pattern.

- Lessons learned from trades that didn’t follow the expected pattern.

Software and Tools for Harmonic Trading

- Overview of software solutions and tools designed for identifying harmonic patterns.

- Tips for choosing the right tools for your trading style and objectives.

Challenges and Limitations

- Common pitfalls in interpreting the Gartley pattern.

- Discussion on the subjectivity of pattern identification and how to overcome it.

The Gartley pattern, with its harmonic approach to market analysis, offers traders a sophisticated lens through which to view price action. By understanding and applying this pattern, traders can enhance their ability to make informed decisions, thereby increasing their potential for success in the volatile world of trading. As we’ve explored the intricacies of the Gartley pattern, it’s clear that its true power lies not only in its predictive capabilities but also in the strategic depth it adds to a trader’s arsenal.